Learn how to manage debts

It's been two years since the global financial

crisis hit us all. Many businesses have closed, and many of us are unemployed.

As a result, we have been unable to meet our basic needs, have difficulty

paying our expenses, and do not have sufficient finances to repay our loans.

When we fail to pay our debts, they

accumulate, and we are more likely to be unable to pay them. We must return to

the basics in this scenario. We must devise a strategy for covering the costs.

To make a plan, we must:

Understand your net worth.

One of the things we take for granted is

this. When we make money, it just passes through our hands and is quickly

spent. We tend to overlook its importance. We are unaware of our earnings.

To figure out your net worth, make a list

of all of your earnings and their sources. You will be able to determine your

real net worth by writing them down.

Make a list of all of your monthly

expenses.

It's scary to list your spending since you

will see if your net worth can support your monthly expenses.

I initially made a list of all my

expenses, including monthly utility bills, credit card payments, and daily

necessities. I was terrified. It had been a horrible experience. That is to

say, I don't have any money left to save, and this hit me hard. Where will I be

able to obtain additional funds to meet my daily requirements? This question

has bothered me so much.

My argument is that knowing your monthly

expenses is essential for understanding your financial situation. So, make a

note on all your monthly utility bills, and you'll be able to figure out what

monthly spending is appropriate for your net worth. You must either work harder

or reduce the costs if your expenses exceed your net worth.

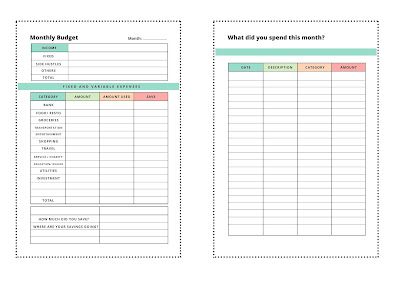

If you're still stuck on where to begin or

what to write, I created a budget spending format that I utilized in my journal

every month. It allows me to keep track of my savings and expenses. If you'd

like to try out this format, drop me an email, and I'll send you a free pdf

copy.

First, pay yourself.

When I had steady employment, I made the

mistake of paying myself first. I was unable to put money aside for savings.

Whenever I earn a paycheck, I promptly pay my monthly payments and reward

myself with expensive meals or useless stuff. There was no more money to save.

It is for this reason that I advise you to pay yourself first. Set aside a

minimum of 10% of your paycheck for savings. Imagine you have a large debt that

needs to pay off immediately before you can do anything else. You will have an

emergency fund when you have built up your savings.

Track your debts.

Lists of debts are also frightening. Yes,

we don't want to see those loans pile up since it causes us stress. But did you

know that when you keep track of your debts, you can see which ones need to pay

off first? Yes, when you write it down, you will see who is going to expire

first and which debts have higher interest rates. You can then plan out which

debts should pay initially.

Some argue that paying off the debt with

the highest interest rate first will prevent it from piling up. Others would

advise settling a lower-value loan first so that you can quickly erase one

debt. It doesn't matter which strategy you use as long as you have a clear

objective of paying off your debt. Click here for more.

To be clear, I am neither a financial

analyst nor a specialist in this sector. I'm also having trouble paying off my

debts, which I'm currently attempting to do. You may also learn more about how

to manage your debt effectively during times of volatility by going here.

These are my current projects. I

understand there is no way to eliminate all bad debts without miracles. We must

take action and overcome this process. To reach financial freedom, let's take a

small action.

Let's be friends and connect with me on Facebook | Twitter | Instagram | YouTube | Pinterest